Credit quarterly newsletter: Alpha by control: how to generate alpha in a low-spread environment

Alpha by control: how to generate alpha in a low-spread environment

Since the market panic in March 2020 induced by the onset of the coronavirus pandemic, the corporate bond markets have performed very strongly, with spreads tightening to historic lows. As a result, many credit investors have been persuaded to take on even more risk to try to reach their performance targets at any cost. At Kempen, we think that’s a mistake as volatility could return to the markets at any time, exposing their clients to significant fat-tail risk.

Technical factors driving the credit markets

Over recent months it’s become clear that both the European and US economies are recovering strongly on the back of large-scale monetary and fiscal support. This is good news for financial markets. Conditions in the credit markets are benign, with no major concerns about fundamental issues: default rates are low, and upgrade/downgrade ratios have moved into positive territory. From the fundamental and cycle perspectives, the credit market looks to be in a good spot.

But what’s really been driving the markets since the onset of the pandemic has not been fundamentals, but technical factors, ignited by global central bank stimulus measures. These have involved direct intervention in the market via asset purchases – not just of government bonds, but also of corporate bonds. This influx of liquidity has inflated asset prices across a broad range of areas, such as equities, the housing market and probably cryptocurrencies as well. Within the credit markets, it’s had the effect of increasing prices across the board – not just those of the highest-quality bonds. With liquidity plentiful and government bond yields low, investors have been moving up the risk spectrum in the hunt for yield, driving spreads down.

What’s also supporting the credit markets is that there has been relatively limited new corporate bond issuance at a time of strong inflows into the asset class. With lots of money chasing relatively few bonds, spreads have tightened even more.

There is another side-effect to historically low credit spreads: spread dispersion between different parts of the credit market is also extremely low. For example, there are no longer major spread differentials between higher-quality and lower-quality bonds within rating buckets, between cyclicals and defensives, or between different levels of subordination. We’re even seeing relatively low spreads between high yield and investment grade, while the spread between BBB and A rated bonds is at an all-time low.

From all of this, we can conclude that at their current levels, valuations are not accurately reflecting the intrinsic risk that investing in companies or individual bonds involves.

How to deliver performance in these challenging market conditions

At Kempen our credit strategies combine top-down inputs with bottom-up, relative-value-focused security selection. We adopt a conservative approach, sticking to our motto of “alpha by control”. We believe this is the best way of outperforming the broad market over the long term, but it does mean the kind of environment we are currently in is challenging.

Our strategy relies on three main sources of alpha.

1. Directionality of the market

The first is the directionality of the market – if it’s moving higher or lower there’s scope to outperform by adjusting the portfolio’s risk profile, but if it’s moving sideways at a time of low absolute spreads, as is currently the case, the contribution from this factor is limited.

2. Bottom-up security selection

The second source is bottom-up security selection based on fundamental analysis in combination with relative value analysis. Which companies are doing well and which are suffering? Which credits are improving or deteriorating, and what’s already priced into spreads? The idea is to look for names with wide spreads that have scope to improve their credit quality and avoid those names that are expected to deteriorate.

In the current environment of compressed spreads, there is little room for improving credits to tighten further. This means that the improving credits that we find have relatively low upside. At the same time, weaker companies involve more downside risk as they are trading at expensive levels so have further to fall.

3. The new issue market

The third main source is the new issue market. To persuade investors to lend them money, companies issuing new bonds often offer a premium. However, due to the dominance of technical factors and the amount of liquidity being pumped into the markets by central banks, the new issue premium has essentially disappeared, limiting another potential source of alpha.

Despite these challenging conditions our strategy is still outperforming its benchmark by close to 20 basis points on a year-to-date basis¹. We are confident that we can continue to outperform the market in this kind of environment, albeit with less alpha potential than we typically aim for over the long term. When these conditions change, we expect our alpha potential to significantly increase again.

Cautious positioning as volatility could return at any time

We see little scope for spreads to tighten further significantly from here, even though technicals are still supportive and fundamentals remain relatively strong. At times like these, when spreads are tight across the board and do not accurately reflect the risk/return profile of individual bonds, we believe the best thing to do is to trade up in quality and adopt a more defensive stance while awaiting better opportunities to arise when volatility returns. By sacrificing only a little bit of spread, we can considerably increase our ability to weather any future bouts of volatility that, as history has taught us, always pop up during the cycle.

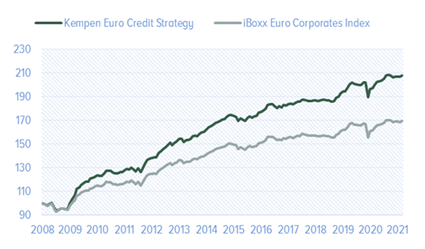

We have been adopting this kind of disciplined approach for the past 13 years, over which time we’ve outperformed the broad credit markets significantly. In fact, we’ve invested through similar periods to today. Back in 2017, we wrote an article discussing much the same points as we are here: spreads were at all-time lows and there was very little spread dispersion. We explained how we had increased our portfolio’s quality ahead of a potential return of volatility rather than chase extra return by taking on more risk.

Graph 1: Kempen Euro Credit strategy long term gross performance

Source: Kempen Capital Management, Performance (in basis points) gross of fees per June 2021

Back in 2017, volatility did indeed return as investors became concerned about Chinese economic growth and the ECB reducing its interventions in the markets, enabling us to strongly outperform the benchmark and our peer group. Volatility will no doubt return this time too, and when it does, it will again create opportunities for us to exploit as spreads widen.

Changes in volatility are very hard to accurately predict and time, but one of the most likely sources is a reduction in central bank intervention in the markets as economies recover and inflation expectations increase. The ECB is likely to remain committed to buying EUR 6 billion of corporate bonds per month until at least March next year, but there have been hawkish comments from Federal Reserve members in recent weeks. These caused equities to fall and bond yields to temporarily go up, and the Fed has already ended some of the programmes it implemented in March 2020. Liquidity is a global phenomenon, so if central banks start moving in that direction it will have an impact on the global credit markets.

Ready to pounce

Even though it’s a challenging time for our strategy, we believe opportunities will emerge as soon as central banks become a less dominant factor and volatility picks up. In the meantime, we continue to focus on trading up in quality and avoiding deteriorating credits. Having said that we’re still finding value in individual securities that have an improving credit profile that is not yet fully discounted in spreads, and are seeing some opportunities in subordinated paper and corporate hybrids.

Conversely, we’re avoiding the lower ratings, so we’re underweight lower-quality investment-grade bonds. We’re also avoiding long-dated bonds as curves are quite flat at present, focusing instead on shorter-dated issues.

We’re also maintaining a healthy cash balance, ready to pounce on any opportunities as they arise.

- Kempen Euro Credit strategy performance gross of fees per June 2021

Disclaimer

Kempen Capital Management N.V. (KCM) is licensed as a manager of various UCITS and AIFs and authorised to provide investment services and as such is subject to supervision by the Netherlands Authority for the Financial Markets. This document is for information purposes only and provides insufficient information for an investment decision. This document does not contain investment advice, no investment recommendation, no research, or an invitation to buy or sell any financial instruments, and should not be interpreted as such. The opinions expressed in this document are our opinions and views as of such date only. These may be subject to change at any given time, without prior notice.

Performance disclaimer

The value of your investment may fluctuate; past performance is no guarantee of the future. These figures are gross of fees; the effect of potential fees and charges is not included. The level of the fees and charges will depend on the applied product structure; this will have effect on the net performance.

There’s a saying in Dutch, Kom verder, it means many things and it’s our business philosophy. It captures the way we work with clients but also the way we steer our investee companies to deliver shareholder value through active engagement.

Capital at risk. The value of investments and the income from them can fall as well as rise, and investors may not get back the amount originally invested. Past performance provides no guarantee for the future.