Why we need a ‘keep 1.5 alive’ equivalent for biodiversity?

COP15 (Part I) in Kunming in early October was focused on halting biodiversity loss, which according to the UN is in “accelerating” and threatens around 1 million animal and plant species with extinction. Moreover, biodiversity is a crucial defence in tackling the wider environmental crisis. Forests and oceans currently absorb more than half of the carbon dioxide the world emits1.

Natural capital flows

Yet how these facts are translated into investment decision-making processes – from developing taxonomies to financial modelling – leaves much to be desired. For example, while we can neatly understand whether a company’s emissions reduction plan is aligned with a pathway to 1.5°C, it is more complex to understand and weigh up a company’s impact on biodiversity.

Kempen is implementing a number of processes which elevate ‘natural capital’ in our decision-making and this month we formalised this in our updated Group-wide Biodiversity Policy.

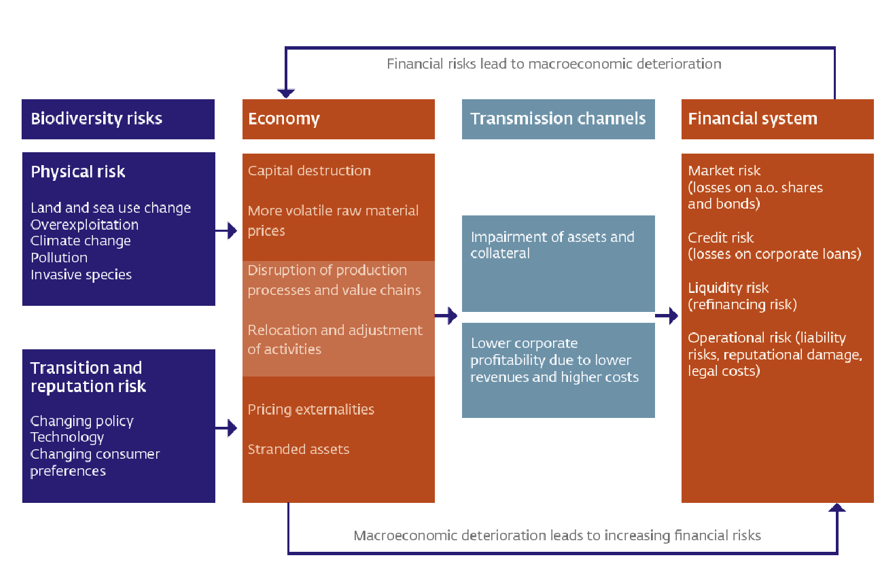

Our Policy recognises that biodiversity loss and the climate crisis are interdependent and sets us on a path to understanding biodiversity risk, reducing the possible negative impacts of our investments on nature and encouraging positive change.

As February’s Dasgupta Report in the UK points out, “Balance sheets should not just include what a government or business can gain by exploiting nature. They should also include what they will lose.”

Kempen and biodiversity

We have undertaken risk assessment based on a benchmark MSCI Index (illustrated below) which set out clearly that the severity biodiversity risk is on the same level as climate change.

We also know that good investments in this area have the potential to boost the resilience of investment portfolios and reduce risk, as well as work for the best interests of people and planet.

Take the Kempen SDG Farmland Fund for example, which invests in farmlands around the world that offer both an attractive return and contribute towards sustainable food production. For the fund, we identified concrete and measurable KPIs linked to climate and biodiversity concerns. Not only does this enable institutional investors to contribute directly towards the SDGs, but also provides a template to meet the forecast increased demand for these types of investments.

We are working with partners on opportunities, including joining the Partnership for Biodiversity Accounting Financials (PBAF) and signing the Finance for Biodiversity Pledge, committing to set concrete targets by 2024. Furthermore, we participate in several working groups on biodiversity, such as by the Dutch National Bank (DNB) and Platform for Biodiversity Accounting Financials (PBAF).

A Paris Agreement for biodiversity

This is all positive progress but ultimately, unlike on climate, there is nowhere near the sort of market-level data and clear targets required to meet the scale of the biodiversity challenge.

At Kunming earlier this year, an actionable framework was unveiled for the first time. Though underwhelming in some respects, the Kunming Declaration pledged more than 100 national governments to include the protection of habitats in decision-making. It’s a start.

Some biodiversity-rich nations are worried about funding and implementation, particularly since some 86% of biodiversity funding comes from public grants, rather than private sector input. However, this could change as financial products and disclosure and reporting systems are trialled specifically for biodiversity, and not just its climate cousin.

The indicators on biodiversity in the EU Sustainable Finance Disclosure Regulation (SFDR) and the Taskforce on Nature-related Financial Disclosure launched earlier this year, will also help. Especially if the latter can grow into something resembling the TCFD framework on climate risk.

To really move the needle though we need global governments to come together and set an end-goal, such as ‘keeping 1.5°C alive’ in the climate realm, that will protect the world’s natural systems and which capital markets can work to deliver.

1.IPBES-IPCC, 2021

Disclaimer

Van Lanschot Kempen Investment Management N.V. (VLK IM) is licensed as a manager of various UCITS and AIFs and authorised to provide investment services and as such is subject to supervision by the Netherlands Authority for the Financial Markets. This document is for information purposes only and provides insufficient information for an investment decision. This document does not contain investment advice, no investment recommendation, no research, or an invitation to buy or sell any financial instruments, and should not be interpreted as such. The opinions expressed in this document are our opinions and views as of such date only. These may be subject to change at any given time, without prior notice.

The value of your investment may fluctuate. Past performance provides no guarantee for the future. The figures presented are gross performance, the effect of potential fees and charges is not included. The level of the fees and charges will depend on the applied product structure, this will have effect on the net performance.

There’s a saying in Dutch, Kom verder, it means many things and it’s our business philosophy. It captures the way we work with clients but also the way we steer our investee companies to deliver shareholder value through active engagement.

Capital at risk. The value of investments and the income from them can fall as well as rise, and investors may not get back the amount originally invested. Past performance provides no guarantee for the future.