Kempen Real Estate Update: Tracking & Engaging: Our approach to getting Real Estate Paris-Proof

Why is Carbon so important for Real Estate specifically?

Real Estate is responsible for about 40% of the global power consumption and about 30% of the global carbon emissions as per UNEPFI. About 10% of Real Estate is located a mere few meters over sea level. The examples of natural disasters materially challenging the Real Estate sector are not new. Hurricane Katrina decimated the New Orleans economy to a point it has yet to recover, Hurricane Ida nearly did the same despite enormous investment in flood protection and Hurricane Maria challenged every single precautionary measure in Miami. And finding solutions is not cheap; twenty-foot dykes cost significantly more than just double the price of a ten-foot equivalent. Still, an increasing amount of assets have become virtually uninsurable given the degree of climate risk. These are at risk of becoming stranded, worthless assets.

Several aspects make climate change specifically tough to fight. Some are listed below:

- The Free Rider dilemma

Already discussed in Kempen Real Estate Update - April 2021 | Kempen. For companies it seems tempting to let other parties do the heavy lifting on carbon reduction and simply profit from others putting the work in. It is up to the financial markets, especially investors, to make prudent climate policies economically rewarding and to hold laggards accountable. - Long horizons versus short term incentives

Climate change is not a problem that can be conquered overnight nor in the upcoming few years. It will take a concerted effort for decades. However, most decision-makers, both in the private and the public spheres, are incentivized on much shorter time-frames. Election cycles typically are between four and six years whilst corporate management is judged on an even shorter basis. This is why investing in the innovation needed is also way beyond the scope of typical decision-makers. - Greenwashing

We have found examples of companies having goals like 5% reduction in emissions over 10 years, companies incorrectly defining carbon intensity as ‘emissions per unit of revenue’ to let inflation help lower the intensity, and, most prevalent, companies using base years for their targets often more than a decade ago, just to make the objectives easier to achieve.

What are we looking for?

When evaluating a company’s climate change preparedness the key performance indicators are Willingness, Ability and Commitment. though we look at a broader array of factors we are most eager to engage on these factors, obviously always using the mantra of an investor’s guide to climate collaboration.

Demonstrating a willingness to adjust and improve practices to be prepared for the long run and measuring the current emissions are all pivotal aspects of preparing for a new, more carbon-conscious reality. Companies lacking a willingness to change will need to be approached, and for lack of better phrasing, educated on the necessity of urgency.

When investigating the climate preparedness of a company one must consider the ability of a company to control the climate preparedness of its assets. Depending on the lease structure a real estate company will have more or less control over its assets. This could result in companies with little control having relatively low ESG scores, most prevalently seen in our US Triple Net sector.

The commitment of a company does not merely start and end at setting an ambitious target, nor even taking the measures to achieve said target. Given the long-term nature of this problem, being truly committed also means being accountable along the way. This means disclosure to the markets to allow investors to oversee efforts, but also internal accountability and oversight by ensuring the board and management have 'skin in the game'. We therefore even seek and encourage management incentives to be linked to the GHG targets set by the various companies.

In our process of tracking and mapping the willingness, ability, and commitment of all companies in our investible universe we have noted a broad set of differences in different sectors and regions. These differences are important and make engagement a more complex and nuanced task than a wholesale fully standardized approach would allow for. As such analyzing the differences is pivotal in effectively getting companies to sign up for the changes, we as investors would like them to make.

Regional and sectoral differences in Green House Gas management

Earlier we already alluded to various degrees of control a company can have over its assets. As shown in this report from GRESB the amount of control a company has will affect how carbon emissions are booked. This means companies can really only be compared with a quite narrow group of peers.

A few of the best practices in various regions do deserve specific mention. In broad terms, American companies will seek external verification and disclose the exact standard used for their Greenhouse Gas “GHG” measurements more often than companies in other regions. Companies in Hong Kong will be more specific in their policy statements and are very meticulous and transparent on the distinction between policies and short-term tactical objectives. European and Australian companies are more advanced in their quest for sustainability, mainly due to proactive actions by companies, encouraged by governments.

The route to seek improvement with companies is identifying best-in-class examples and holding companies accountable consistently. Being critical of plans yet reasonable and keeping an unwavering eye on 2050 and literal carbon neutrality. Ideally, we look for broad positive changes at the margin.

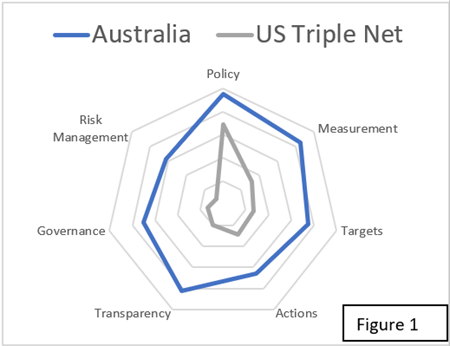

One factor to keep track of is whether companies with less control of their assets will use this as an excuse to not do much. An example of a company that has legitimate worries of lack of control, yet trying to do better is Realty Income Corp. As a triple net lease company, the amount of control is very limited. Despite this drawback, the group has actively started setting up green clauses in their leases in Europe and is rolling out similar practices in the US. These measures are still in their infancy, but given the scale of Realty Income, it will provide the most lagging sector in Real Estate an excellent example of how to do better. Figure 1 on the next page shows that there is still a discrepancy between US Triple net and Australian companies, which are best in class. Clearly, the US Triple Net sector still has a long way to go.

How to be better?

To evaluate companies on sustainability, Van Lanschot Kempen has developed a Carbon Framework to which all companies in the investable universe have been subjected. It is a measure to quantify and track the key performance indicators described earlier. Monitoring the improvements and continuously holding companies accountable is being integrated into the investment process. Using a framework with a predetermined scoring model will aid consistency and comparability.

Realty Income Corp. is a good example of the dual approach one must wield when trying to make companies act and be better. One needs to at simultaneously push the ESG leaders in a subsector to do better pull the laggards towards the example set by said leaders.

Another aspect is to keep top of mind, is a relentless approach with a relationship mindset. Push too hard and relationships with companies can sour; don’t push hard enough and companies will not do what they can. The relationship component is especially relevant in non-listed real estate, as one cannot rely solely on publicly available information in this market, making relationships and dialogue crucial.

Perhaps the most important factor however is to practice what we preach. Not only is it easier to ask companies to do as you do yourself, but it also boosts credibility.

What is left to figure out?

As previously discussed the quest for high-quality consistent ESG data is at this point still ahead of us. Still tracking trustworthy, standardized, externally verified data in line with universal standards like the GHG Protocol will form the basis of standardization. Even so, there are very local aspects to consider like local climate and access to economically feasible renewables. 53% of the companies in our universe have yet to commit to carbon neutrality and 39% of the same companies have no significant GHG targets whatsoever. The battle for climate neutrality is still in its infancy, but Kempen’s Real Assets team is rising to the challenge and hoping to help our investees along in the process.

Even though we realize the overall tone of this piece has been rather skeptical we would like to end on an optimistic note. Companies, technology, and the sciences will become more efficient in preserving our environment, our buildings, and our future. The drive to make our world better will drive economic opportunities, innovation, and, for those who will consider the future, investment returns. We, at Van Lanschot Kempen Real Assets team shall continuously strive to be at the forefront of what will be the most transformative phase for Real Assets in a few generations. We shall do this by supporting Sustainability Leaders that lead, and challenge Sustainability Laggards to catch up, by helping them with their plans and providing them a partnership.

In conclusion, we’ve started this path of sector-wide engagement, because this sector’s potential for decarbonization should not be underestimated.

Important Information

The views expressed in this document may be subject to change at any given time, without prior notice. Kempen Capital Management N.V. (KCM ) has no obligation to update the contents of this document. As asset manager KCM may have investments, generally for the benefit of third parties, in financial instruments mentioned in this document and it may at any time decide to execute buy or sell transactions in these financial instruments.

The information in this document is solely for your information. This article does not contain investment advice, no investment recommendation, no research, or an invitation to buy or sell any financial instruments, and should not be interpreted as such. This document is based on information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such.

The views expressed herein are our current views as of the date appearing on this document. This document has been produced independently of the company and the views contained herein are entirely those of KCM.

KCM is licensed as a manager of various UCITS and AIFs and to provide investment services and is subject to supervision by the Netherlands Authority for the Financial Markets.

There’s a saying in Dutch, Kom verder, it means many things and it’s our business philosophy. It captures the way we work with clients but also the way we steer our investee companies to deliver shareholder value through active engagement.

Capital at risk. The value of investments and the income from them can fall as well as rise, and investors may not get back the amount originally invested. Past performance provides no guarantee for the future.