Kempen Real Estate Update: Bringing Private Real Estate Back to the Future

Private real estate funds

Private real estate funds are structures that pool capital from investors to fund the purchasing of properties according to a certain mandate. This means that investors are not involved with the responsibility of owning or operating the buildings, as this is taken care of by the fund managers themselves; all for a fee, of course. These funds often follow a particular strategy within a real estate sector such as logistics, offices, retail or even a combination resulting in a diversified approach.

Broadly speaking, these funds can be categorized as either closed-ended or open-ended. For closed-ended funds, investors commit capital and are ‘locked in’ until the fund’s maturity date (typically 7 years or more). Open-ended funds differ, by allowing investors to trade in and out of the fund in line with a predefined quarterly liquidity mechanism.

So what is the traditional way of investing in this space?

The status quo

Investment model

Traditionally, investors form a long list of opportunities and use a list of selection criteria to filter down to one or two funds. This standard process relies heavily on historical performance to guide investment decisions. The result is that funds receive numerous investments if they have been posting positive performance figures, resulting in longer capital queues on the way in. At the other end of the spectrum, funds receive multiple outflows when performance has been poor/negative, which also creates long queues on the way out.

Engagements

What happens after the initial investment? The chosen fund will typically be monitored by the investor on a quarterly basis. Any engagement on key matters like sustainability, strategy or portfolio, is only done with the chosen fund manager, and all alternative investments that were considered in the search process are left by the wayside.

Why is this broken?

The above process is broken because it reduces the chance of creating alpha and having an impact; sustainable alpha.

Investment model:

Don’t look back, we’re not going that way

The backward-looking investment model kills returns. Investors commit to a fund based on past positive performance, without taking a view of expected returns to come. Through this short-sightedness, investors are more likely to overlook sectors going through a significant change in fundamentals. This means tactical switches to enhance returns become unlikely. This is exacerbated by the fact that following this process results in a narrow focus on only one or two chosen funds. By not taking a broader, forward-looking view, investors lose out on alpha generation.

Bad Timing!

Investors’ lack of foresight leaves client money at the mercy of capital queues. Queues are crowded on the way in, so no returns are earned while waiting to be called. Redemption queues are also crowded on the way out, so exposure to negative returns continues until the managers sell properties and return the capital. Returns are therefore sacrificed at both ends.

An example to illustrate our point:

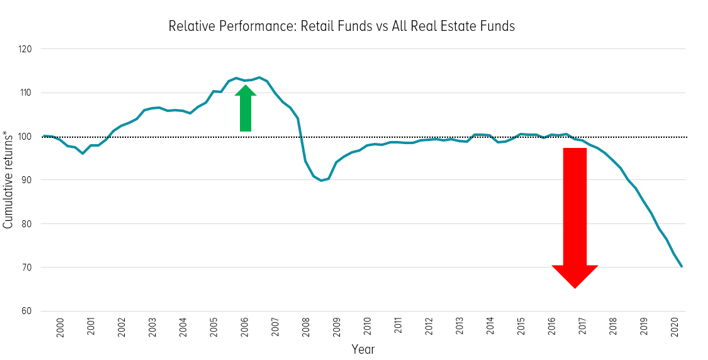

Under the backward-looking model, investors would have invested heavily into retail funds in 2006/2007 due to the strong performance since 2000 (see Figure 1 below). Retail saw strong structural declines and produced the worst relative returns for the following 10 years. Even if an investor wanted to switch clients out of retail funds and into industrial or residential funds, they would have struggled for years to do so because of static redemption queues.

Figure 1: Relative Performance: European Retail Funds vs All European Real Estate Funds

Source: INREV, Kempen

*Indexed to 100 at Q2 2000

Engagements:

A narrow view misses the big picture

Investors following the traditional process only engage with the funds they have invested in, and we view this as unacceptable.

When it comes to crucial engagements around sustainability, small efforts are not enough. Climate risk is the key issue for our generation. As written in our upcoming Climate Engagement Handbook:

“One fund may be streaks ahead, but this in itself does not mean it is protected from climate risks, and the long-term success of our portfolios – and our planet - depends on sector-wide improvements. As active investors, we have a responsibility to use our power to drive forward change through our control of capital.”

Investors should be able to exert their influence on more than one or two funds to truly have an impact, and the time for impact is now.

A new way forward

Broader, faster, and always forward-looking

Ideally, the private universe would be tracked in a more efficient way: using ongoing monitoring and analysis of funds and their peer-set, within financial models that are constantly fed with data and forward-looking fundamental views of analysts. Apples-to-apples comparisons can be made seamlessly, with expected winners being clearly distinguished from the losers. Funds and sectors with the highest expected upside can be selected, and capital can be deployed in a shorter time frame. If fundamentals change, like risk/return characteristics and/or ESG requirements, the models will be updated to reflect this and tactical switches can be made quickly and with conviction.

This is precisely why we at Kempen prefer open-ended funds over closed-ended funds. Open-ended funds, through their quarterly liquidity mechanism, provide investors with the flexibility to buy/sell when fundamentals change; return-enhancing, risk-reducing and time-saving.

Stakeholders deserve more, and investors can do more

A broader view enables more impact to be made. By diligently tracking and maintaining open dialogues with multiple funds within the investable universe, meaningful feedback points and sector-wide ESG views can be communicated and explained to fund managers. This brings all players to a higher level, leading to sector-wide improvements and impact.

The Kempen way

This new way forward is exactly what we embody and execute as the Kempen Real Assets Team.

Through this rejuvenated way of investing, we pave the way for alpha and impact.

Important Information

The views expressed in this document may be subject to change at any given time, without prior notice. Kempen Capital Management N.V. (KCM ) has no obligation to update the contents of this document. As asset manager KCM may have investments, generally for the benefit of third parties, in financial instruments mentioned in this document and it may at any time decide to execute buy or sell transactions in these financial instruments.

The information in this document is solely for your information. This article does not contain investment advice, no investment recommendation, no research, or an invitation to buy or sell any financial instruments, and should not be interpreted as such. This document is based on information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such.

The views expressed herein are our current views as of the date appearing on this document. This document has been produced independently of the company and the views contained herein are entirely those of KCM.

KCM is licensed as a manager of various UCITS and AIFs and to provide investment services and is subject to supervision by the Netherlands Authority for the Financial Markets.

There’s a saying in Dutch, Kom verder, it means many things and it’s our business philosophy. It captures the way we work with clients but also the way we steer our investee companies to deliver shareholder value through active engagement.

Capital at risk. The value of investments and the income from them can fall as well as rise, and investors may not get back the amount originally invested. Past performance provides no guarantee for the future.