22 May 2023

Fed Up, Markets Down

There are always conflicting opinions amongst participants in financial markets. It is, after all, conflicting opinions that enable markets to function efficiently at all. Opinions at the moment however seem to be unusually diverse around the future path of US monetary policy.

- Firstly, there is much discussion about whether the Fed should be concentrating on financial stability or inflation.

- Secondly, there are very large differences between what the Fed themselves expected and what market participants are expecting the future path of short rates to look like.

- And finally there is a divergence between what risky assets behaviour and what risk free assets are seemingly telling us about the future.

The answer will likely have a significant bearing on both the global economy and asset prices. It is therefore worth examining these current issues in a little more detail.

Conflicting objectives

There is on the face of it a conflict between controlling inflation or achieving financial stability. In an ideal world there would be no compromise; banks and non-financial firms would be able to adjust smoothly to increases in interest rates without disruption. However, this is not an ideal world and to paraphrase Warrant Buffet, when the tide goes out it is very common to discover some people having been partaking in naked swimming. This is particularly true in this monetary cycle, where short dated US rates have risen at their fastest pace for 40 years after a period of unprecedentedly low rates; it is not surprising that there will be some structural adjustments. And, within acceptable bounds, this is exactly what the Fed wants to happen. Rising rates are supposed to dampen credit creation, restrict demand, create spare economic capacity and higher unemployment. This is the part of the business cycle that reduces inflation and eventually creates greater prosperity for all. The issues in the regional banks are not particularly welcome - banking crisis never are - but, as long as they remain limited in scope, there is no reason to think they should hamper the fight against inflation. The Fed clearly does not think so, having raised rates another 0.5% since SVB bank collapsed in March. Previously, such disruption in the financial sector may have caused a re-assessment of the trade-offs but, having been slow off-the-mark in reacting to the increase in inflation, the Fed are in no mood to gamble with credibility. Bond participants seem to think differently.

Irrational expectations?

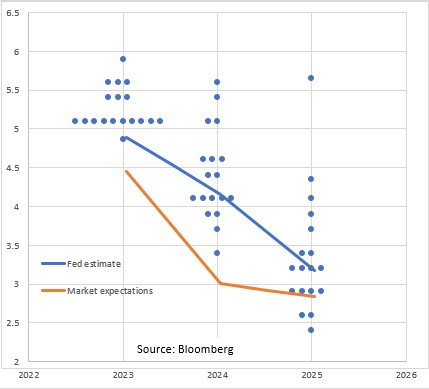

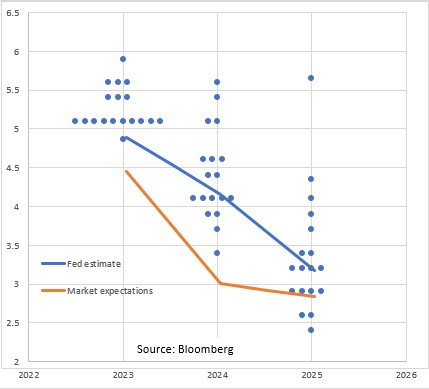

If we now consider the difference between what the Fed is signalling and what market participants are expecting to happen, the most recently released ‘dot plot’ shows where individual Fed members see the Fed Funds Rate being at the end of 2023, 2024 and 2025. The median number is slightly above 5%, not inconsistent with current levels i.e. the Fed is going to be holding rates steady for the rest of 2023. This is drastically different from market expectations, where futures markets are anticipating year end rates at 4.4%, or around three full 0.25% cuts below where the Fed is anticipating. The same is true in 2024: the Fed is expecting rates to be around 4.25%, the market is expecting 2.75%, an even bigger gap. What is driving these divergences?

Graph 1: Fed's expectations

Source: Bloomberg

Fundamentally, market participants expect inflation to fall quicker than the Fed is expecting. The latest inflation forecasts are from mid-March, where they expect their favoured inflation index, Personal Consumption, to be 3.3% by the end of 2023 and 2.5% at the end of 2024. Market based inflation measures at the same time for 1 and 2 year inflation were around 2.5%. However the measure of inflation that the Fed is forecasting is different from that used in US inflation swaps. Over the last 5 years the index used in in inflation swaps has been approximately 0.7% higher than the Personal Consumer Expenditure index forecast by the Fed. As such, market based measures are substantially lower than Fed forecasts.

Volatile times

For inflation to fall as much as markets expect, we would require an increased output gap and consequently lower employment and lower output, and in all likelihood a recession. And this would indeed cause the Fed to reduce to interest rates quickly. But investment grade and high yield credit spreads remain below their long term averages and equities are only 13% off their all time highs having risen 15% from the low point in Q4 2022. Signals from financial markets are far from pricing a recession. Which brings us to our final disconnect: either the Treasury market is wrong or the equity and credit markets are. As always with turning points in the rate cycle, volatility is likely to be elevated and given the scale of these divergences, the adjustments that will have to be made to current assumptions either by markets or the Fed will need to happen quickly.

- Firstly, there is much discussion about whether the Fed should be concentrating on financial stability or inflation.

- Secondly, there are very large differences between what the Fed themselves expected and what market participants are expecting the future path of short rates to look like.

- And finally there is a divergence between what risky assets behaviour and what risk free assets are seemingly telling us about the future.

The answer will likely have a significant bearing on both the global economy and asset prices. It is therefore worth examining these current issues in a little more detail.

Conflicting objectives

There is on the face of it a conflict between controlling inflation or achieving financial stability. In an ideal world there would be no compromise; banks and non-financial firms would be able to adjust smoothly to increases in interest rates without disruption. However, this is not an ideal world and to paraphrase Warrant Buffet, when the tide goes out it is very common to discover some people having been partaking in naked swimming. This is particularly true in this monetary cycle, where short dated US rates have risen at their fastest pace for 40 years after a period of unprecedentedly low rates; it is not surprising that there will be some structural adjustments. And, within acceptable bounds, this is exactly what the Fed wants to happen. Rising rates are supposed to dampen credit creation, restrict demand, create spare economic capacity and higher unemployment. This is the part of the business cycle that reduces inflation and eventually creates greater prosperity for all. The issues in the regional banks are not particularly welcome - banking crisis never are - but, as long as they remain limited in scope, there is no reason to think they should hamper the fight against inflation. The Fed clearly does not think so, having raised rates another 0.5% since SVB bank collapsed in March. Previously, such disruption in the financial sector may have caused a re-assessment of the trade-offs but, having been slow off-the-mark in reacting to the increase in inflation, the Fed are in no mood to gamble with credibility. Bond participants seem to think differently.

Irrational expectations?

If we now consider the difference between what the Fed is signalling and what market participants are expecting to happen, the most recently released ‘dot plot’ shows where individual Fed members see the Fed Funds Rate being at the end of 2023, 2024 and 2025. The median number is slightly above 5%, not inconsistent with current levels i.e. the Fed is going to be holding rates steady for the rest of 2023. This is drastically different from market expectations, where futures markets are anticipating year end rates at 4.4%, or around three full 0.25% cuts below where the Fed is anticipating. The same is true in 2024: the Fed is expecting rates to be around 4.25%, the market is expecting 2.75%, an even bigger gap. What is driving these divergences?

Graph 1: Fed's expectations

Source: Bloomberg

Fundamentally, market participants expect inflation to fall quicker than the Fed is expecting. The latest inflation forecasts are from mid-March, where they expect their favoured inflation index, Personal Consumption, to be 3.3% by the end of 2023 and 2.5% at the end of 2024. Market based inflation measures at the same time for 1 and 2 year inflation were around 2.5%. However the measure of inflation that the Fed is forecasting is different from that used in US inflation swaps. Over the last 5 years the index used in in inflation swaps has been approximately 0.7% higher than the Personal Consumer Expenditure index forecast by the Fed. As such, market based measures are substantially lower than Fed forecasts.

Volatile times

For inflation to fall as much as markets expect, we would require an increased output gap and consequently lower employment and lower output, and in all likelihood a recession. And this would indeed cause the Fed to reduce to interest rates quickly. But investment grade and high yield credit spreads remain below their long term averages and equities are only 13% off their all time highs having risen 15% from the low point in Q4 2022. Signals from financial markets are far from pricing a recession. Which brings us to our final disconnect: either the Treasury market is wrong or the equity and credit markets are. As always with turning points in the rate cycle, volatility is likely to be elevated and given the scale of these divergences, the adjustments that will have to be made to current assumptions either by markets or the Fed will need to happen quickly.

Disclaimer

Van Lanschot Kempen Investment Management (UK) Limited (VLK IM) is a company registered in England and Wales with company number 02833264. Van Lanschot Kempen Investment Management Ltd is authorised and regulated by the Financial Conduct Authority (“FCA”) with Firm Reference Number 166063.

Registered office: Octagon Point, 5 Cheapside, London, EC2V 6AA.

Van Lanschot Kempen Investment Management (UK) Limited (VLK IM) is a company registered in England and Wales with company number 02833264. Van Lanschot Kempen Investment Management Ltd is authorised and regulated by the Financial Conduct Authority (“FCA”) with Firm Reference Number 166063.

Registered office: Octagon Point, 5 Cheapside, London, EC2V 6AA.

There’s a saying in Dutch, Kom verder, it means many things and it’s our business philosophy. It captures the way we work with clients but also the way we steer our investee companies to deliver shareholder value through active engagement.

Capital at risk. The value of investments and the income from them can fall as well as rise, and investors may not get back the amount originally invested. Past performance provides no guarantee for the future.