Analysis: sustainable stocks hold up in the face of sharply rising carbon price

More and more companies are paying for the right to emit CO2. Several countries and supranational institutions, including the European Union (EU), have established laws and mechanisms regulating the prices and tradability of CO2 emission allowances: companies can choose between paying (more) for CO2 emissions or investing in cleaner alternatives, with supply and demand ultimately determining the price.

The ultimate goal is CO2-neutral production and meeting the goals of the Paris climate agreement. To achieve this, the number of available emission allowances - especially in the EU - is limited and falls every year under this scheme. Last week, the EU Parliament announced a new scheme to reduce emissions, with even fewer allowances available and the phasing out of free allowances.

Strong rise means strong fall

Van Lanschot Kempen conducts annual research into the effect of CO2 prices on equity markets. In 2022, we updated our model to include a scenario in which the emission price per tonne of CO2 rises by $100. Our analysis shows substantial impact on equity markets worldwide.

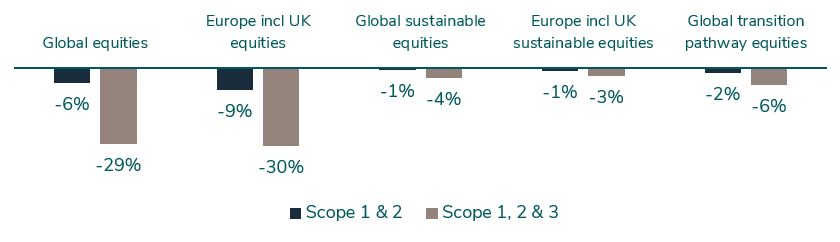

In this scenario, the fall in share prices averages 6%, were only scope 1 and scope 2 emissions (emissions caused by the company itself and the use of energy) to be priced. Were scope 3 emissions (the emissions in supply chains and product delivery) included as well, average share prices would fall by 29%, according to our model.

In Europe (including the UK), the CO2 effect, when increased by $100 per tonne, would be even more dramatic: it would lead to equity markets falling by 9% (pricing of scope 1 and 2) and 30% (pricing of scope 1,2 and 3).

Impact on equity markets of $100 increase in carbon price

Source: Kempen Capital Management, December 2022

Michel Iglesias del Sol, Chief Investment Strategist at Van Lanschot Kempen, thinks the focus on reducing CO2-emissions should and will get bigger in the near future and that a $100 rise may not be enough to meet the targets of the Paris agreement. ''That is why we have also calculated a scenario in which the global CO2 price for polluting companies increases by $150 per tonne. In this case, the impact on markets becomes even stronger. Markets could fall by 9% if only scope 1 and 2 emissions are priced, and by 43% if prices were to apply to scope 1, 2 and 3 emissions. In Europe, this would involve decreases of 14% and 44% respectively''.

Impact on equity markets of $150 increase in carbon price

Source: Kempen Capital Management, December 2022

Sustainable equities hold up: a solution for big investors?

Interestingly, the analysis shows that global sustainable equities are far less impacted than traditional alternatives. Sustainable counterparts would ‘’only’’ fall by 1% and 4% in the case of a $100-per-tonne CO2 price rise (scope 1,2 and scope 1,2,3). Even with a stronger $150 price rise, sustainable indices remain significantly better protected, with global declines of 6-9% and up to 4% in Europe.

Investors can thus reduce their carbon price risk by 70% to 80% by choosing an appropriate sustainable benchmark for a global equity portfolio. For a European equity portfolio, this risk can even be reduced by 90 per cent. Such an index could consist of companies that are well prepared for the energy transition and are frontrunners in sustainability.

Michel Iglesias del Sol: ''Our research indicates that neither the costs nor the benefits of a transition towards lower CO2 emissions are fully captured by equity markets. Long-term investors, such as pension funds, should therefore reposition their equity portfolios to make them more resilient to changes in carbon pricing and environmental regulation.'' 1

What are the chances of co2 prices actually rising?

Currently, the average global price of CO2 is around $5 per tonne, the International Monetary Fund (IMF) estimates; a level which falls far short of reflecting the need to move towards net zero and decreasing the number of emission allowances.

At the recent climate summit in Egypt, the IMF argued that the price should go to $75 per tonne 2. The IPCC, the United Nations climate panel, estimates that to meet 'Paris' targets, a price of at least $100 per ton is necessary.

Problematically, only a quarter of global CO2 emissions are currently priced. However, the number of pricing systems and countries joining them is growing steadily. Iglesias Del Sol: ''It is therefore very likely that CO2 prices will rise in the near future. The imperative to do so may also be accelerated by geopolitical tensions, rising energy prices, and the possible introduction of CO2 border charges’’. The recent EU carbon deal only highlights the probability of a sharp rise.

Van Lanschot Kempen believes that a substantially higher price is necessary to meet the goals of the climate agreement, especially in developed economies. We assume worst-case scenarios in our analyses, but the price rise is expected to be spread over a number of years. Even then, large investors will have to prepare for higher carbon prices.

How to reduce carbon risks?

Van Lanschot Kempen wants to help its clients navigate through the current climate and energy transition. We analyse how climate change mitigation initiatives can be integrated into investment analysis and seek opportunities to reduce carbon risk in clients’ portfolios. Opportunities are created by including shares of companies that focus on low-carbon operations or other climate-transition activities. Existing stakes in ''grey'' companies, on the other hand, should be wound down.

Another option is investing in green technology through new, targeted allocations within private and public markets. These include thematic strategies with a focus on clean energy, clean water, or innovative approaches to agricultural land. Such strategies are expected to benefit from the climate transition in the longer term and actually mitigate physical climate risks. They also include investments in greener infrastructure and impact-oriented private equity strategies.

1. The research analyses both the impact of different carbon prices on equity markets, implemented through either a carbon tax or emissions trading scheme (ETS), and also the effect of higher prices across emissions Scopes 1 to 3 on different parts of company value chains. Van Lanschot Kempen has modeled this analysis as a change in carbon pricing, not an absolute level; i.e. the $75 analysis concerns a $75 increase rather than an absolute price of a $75.

2. Reuters, 2022 November 7th

Disclaimer

The views expressed in this document may be subject to change at any given time, without prior notice. Van Lanschot Kempen Investment Management N.V. (VLK IM) has no obligation to update the contents of this document. As asset manager VLK IM may have investments, generally for the benefit of third parties, in financial instruments mentioned in this document and it may at any time decide to execute buy or sell transactions in these financial instruments.

The information in this document is solely for your information. This article does not contain investment advice, no investment recommendation, no research, or an invitation to buy or sell any financial instruments, and should not be interpreted as such. This document is based on information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such.

The views expressed herein are our current views as of the date appearing on this document. This document has been produced independently of the company and the views contained herein are entirely those of VLK IM.

VLK IM is licensed as a manager of various UCITS and AIFs and to provide investment services and is subject to supervision by the Netherlands Authority for the Financial Markets.

There’s a saying in Dutch, Kom verder, it means many things and it’s our business philosophy. It captures the way we work with clients but also the way we steer our investee companies to deliver shareholder value through active engagement.

Capital at risk. The value of investments and the income from them can fall as well as rise, and investors may not get back the amount originally invested. Past performance provides no guarantee for the future.