Sustainable investment: The ‘why’ is clearer, as the ‘how’ get more complex

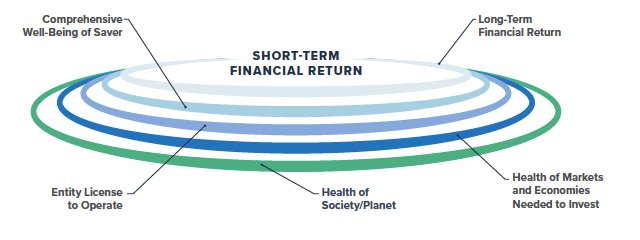

This concept is illustrated in a new report, ‘Ripples of Responsibilities’, written by the Kempen-supported initiative FCLT (‘Focusing Capital on the Long Term’) - which likens investor responsibility to a rippling pond.

Short-term financial returns are where a stone drops in the water, but investments also create, and depend upon, the outer ripples of long-term value, healthy markets and a healthy planet. The FCLT study underlines that the way investors navigate these ‘ripples’ of responsibility has a tremendous effect on long-term success.

This illustrates the ‘why’ of sustainable investment, and so does the bottom line. ESG risk is investment risk, so those firms best managing sustainability risks and opportunities also tend to be the most compelling businesses.

Hence we are seeing funds such as Kempen’s Sustainable High Dividend strategy – which marries a substantial dividend yield with strict sustainability criteria –return over 29%1 since its inception in 2020.

Across the market we saw ESG funds outperform their peers in 2020, with one study finding that, on average, ESG funds delivered a return of 22.3%, versus the global sector average of 13.2%.

Our own study on the effect of incorporating ESG factors on financial performance has similarly found that, in equities and credit, it tends to compete with conventional funds in good times and perform better during times of crisis like the current COVID-19 downturn.

But financial returns are only the start of the ‘why’ for sustainable investment.

Investors also have the power to make a difference in global challenges from climate to coronavirus response.

Just one example has been our ongoing engagement with Coats Group, a British manufacturer of industrial threads for the clothing sector. As responsible stewards we asked the company to undertake an analysis of whether its operations were paying in line with local living wage standards. It emerged that over 700 employees in five countries - while meeting the legal minimum wages - were falling slightly short of the living wage payments and the company has since remediated those cases. In response to the global pandemic the company also took action to secure all factory jobs in low income countries where its workers could not rely on social security, and is providing workers in highly-impacted countries such as India with additional healthcare benefits.

But the ‘how’ is getting more complex

As the case for sustainable investment has become ever clearer however, there has also come greater complexity on how to do it.

In Europe, the implementation of the EU Sustainable Finance Disclosure Regulation (SDFR), which will also be mirrored in the UK, means new complex disclosure requirements to meet. And the EU Taxonomy, and its associated ecolabels and climate benchmarks, has given an impetus to sustainable investors to agree on definitions on what is ‘green’ or ‘sustainable’, and what is not. Something we at Van Lanschot Kempen fully support as written in detail previously. Another dimension that is adding to complexity is the lack of availability of good quality, complete and reliable data that is needed for integration and disclosure requirements.

There is also more standardised reporting on climate risk in the form of TCFD (Task Force on Climate-related Financial Disclosures), and an emerging similar standard on nature in the form of the G7-backed Taskforce on Nature-related Financial Disclosures (TNFD). In the US, President Biden is increasing the pace of non-financial standards for investors and companies in the US with the Securities and Exchange Commission (SEC) currently discussing how ESG risks should be disclosed.

There is also more effort to compare investors’ ESG performance than ever before, with benchmarks such as those run by VBDO (NL) and ShareAction (UK) ranking and rating asset owners on their sustainable investment commitments and performance.

Thus, while embracing sustainable investing and brining clarity to the field is important, investors now need to learn to navigate the regulatory requirements, transparency, data issues, emerging themes and the growing effort of benchmarking and comparing investors to each other.

Our approach: focus on your core purpose

At Van Lanschot Kempen we are proud to take a leadership role in this area, and work intensively with all types of clients, including private clients and those we prove fiduciary services to, to help investors navigate the changing intricacies of how to be a sustainable investor.

As the ‘ripples of responsibility’ suggest, we believe that investors need to start from reconfirming their purpose and assessing which expectations from stakeholders they will drive, comply with, defer or decline.

Each individual investor must focus and define their own approach for how to implement sustainable investment.

In 2020, for example, we worked with a long-term client, to develop a bespoke sustainability index for the fund’s European equity investments. The tailor-made index we helped devise with the client, consists of about 200 companies and seeks to reward companies taking ambitious climate action, and those that contribute to the treatment of important illnesses, food security and the prevention of pollution. It also assesses pharmaceutical companies on their pricing policies and whether they were enabling fair access to medicine.

Walking our talk

At Van Lanschot Kempen, our core purpose – the creation of long-term value creation for our clients and society in a sustainable way – is written into all that we do including our recent climate policy, implementation of our ‘Sustainability Spectrum’ and many other sustainable investment highlights.

It is an approach that this year saw the Van Lanschot Kempen Group, of which Kempen Asset Management is a part, adopt sustainability as a strategic ambition for the entire Group. Since we made this move we have already seen a huge demand from our private banking clients for more sustainable and impact investment, moving money from regular investment solutions to sustainable solutions such as the Sustainable+ (Duurzaam+) proposition and our Global Impact Pool.

Time for investors to change

With less than six months to the COP26 climate meeting, and as the world tries to build back better in the wake of COVID-19, it has never seemed more important to disprove the famous quote about investors that they ‘know the price of everything, but the value of nothing.’

To do so investors, and the entities that they invest in, must show that in creating value they are benefiting not just bottom lines, but all stakeholders in society. This can create a positive ripple effect to help us meet the enormous sustainability challenges we all face.

Browse our Stewardship and Sustainability Report 2020 for more.

- Kempen, gross performance as on 31/05/2021

Disclaimer

Kempen Capital Management N.V. (KCM) is licensed as a manager of various UCITS and AIFs and authorised to provide investment services and as such is subject to supervision by the Netherlands Authority for the Financial Markets. This document is for information purposes only and provides insufficient information for an investment decision. This document does not contain investment advice, no investment recommendation, no research, or an invitation to buy or sell any financial instruments, and should not be interpreted as such. The opinions expressed in this document are our opinions and views as of such date only. These may be subject to change at any given time, without prior notice.

The value of your investment may fluctuate. Past performance provides no guarantee for the future. The figures presented are gross performance, the effect of potential fees and charges is not included. The level of the fees and charges will depend on the applied product structure, this will have effect on the net performance.

There’s a saying in Dutch, Kom verder, it means many things and it’s our business philosophy. It captures the way we work with clients but also the way we steer our investee companies to deliver shareholder value through active engagement.

Capital at risk. The value of investments and the income from them can fall as well as rise, and investors may not get back the amount originally invested. Past performance provides no guarantee for the future.