Working together to create an integrated impact portfolio

A transparent process to create impact: we assist our clients at every stage. Our impact services start with us advising on those impact goals and themes on which clients want to have an impact. This could be for the theme of Climate or Health, for example. Within these themes clients can then choose sub-themes, such as the energy transition or improved access to healthcare. For each (sub-)theme we formulate tangible and measurable objectives (KPIs). In addition to this, our advisory services consist of:

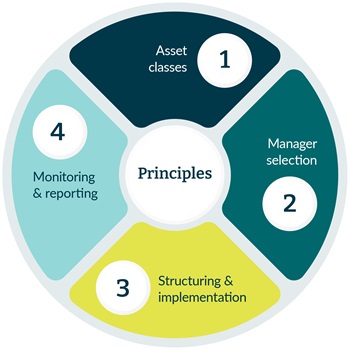

A transparent process to create impact: we assist our clients at every stage. Our impact services start with us advising on those impact goals and themes on which clients want to have an impact. This could be for the theme of Climate or Health, for example. Within these themes clients can then choose sub-themes, such as the energy transition or improved access to healthcare. For each (sub-)theme we formulate tangible and measurable objectives (KPIs). In addition to this, our advisory services consist of: 1. Advice on asset classes and guidelines

Together with the client, we identify those asset classes eligible for realising the desired impact. We apply an integrated approach and take all the criteria that the investments need to meet into account here. We review the desired regional and sector allocation within the total portfolio. Another option is to integrate impact into the asset classes in which the client already invests. Next, we create a formal framework containing the strategic decisions. This is the first step towards translating the impact and ESG objectives into a tangible investment policy.2. Manager selection

We seek suitable impact managers based on the implementation criteria set by the client. The initial selection yields a longlist and then a shortlist of managers. A site visit may form part of the selection process. If there are no off-the-peg solutions that constitute a good match for the client, we work with the chosen manager to create a new mandate or fund that is fully aligned with the client’s impact wishes.3. Structuring & implementation

Once a decision on a manager has been made, we advise the client on the best investment structure. If this involves a new fund or mandate, we work with the manager to launch the impact solution. Following the launch, we conduct portfolio management within the set guidelines.4. Monitoring & reporting on impact goals

We provide the client with insight into the impact performance of the selected manager, the activities that are carried out to achieve the set impact goals and the actual impact that has been realised.In addition, we report on the progress towards the impact themes chosen by the client. This enables the client to retain full control of the portfolio and make adjustments where necessary.

We are also happy to help with communications to stakeholders. We believe it is important to show pension fund members how the pension fund makes a positive contribution to global problems.

There’s a saying in Dutch, Kom verder, it means many things and it’s our business philosophy. It captures the way we work with clients but also the way we steer our investee companies to deliver shareholder value through active engagement.

Capital at risk. The value of investments and the income from them can fall as well as rise, and investors may not get back the amount originally invested. Past performance provides no guarantee for the future.

Our team

Johan van Egmond

Head of Institutional Relations – NL