Impact investing

From goal to measurable result

Go to

Why impact investing?

Fiduciary advice

Sustainable goals

Local Impact

Impact solutions

Working together to create an integrated impact portfolio

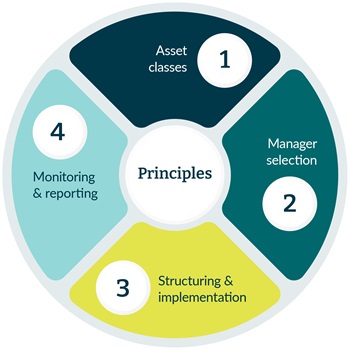

5D investing: an integrated approach

Having an impact via private market asset classes

The new impact investing

Impact investing is evolving. Discover how institutional investors are increasingly taking a systemic approach and actively contributing to a more inclusive and future-proof society. This video explores the latest developments in the new era of impact investing.

Partnership with Collective Action

We have a perennial partnership with Collective Action, a 100% private markets impact specialist. The goal of this collaboration is to further broaden our knowledge and experience in impact investing and to gain better access to the market of impact solutions. The partnership will strengthen our advisory services and provide clients with additional opportunities to invest in high-quality impact investments, particularly in the field of biodiversity.

Connect with our experts

Meet the rest of our team

Insights

Subscribe to our Insights

Make sure you never miss out on our thought-leadership or insightful events

1.

1.